Payment

Solutions

Processing

Technology

Solutions

Built to Move

Your Business Forward

Kadima Payments is a full-service payment processing and infrastructure platform for growing, complex, and regulated businesses — built for reliability, transparency, and scale.

Get Approved Now

Connected Payments. Infinite Possibilities.

Kadima plugs into your stack — gateways, carts, POS, CRM, and APIs — so you control how payments move as you scale.

Dual pricing, ACH, flexible underwriting, and RapidPayLink for AR — built for businesses consumer tools can’t support. Learn about complex approvals.

Backed by the brands your customers already trust. Powered by Kadima.

Accounts Receivable Infrastructure for modern operators

Accounts Receivable Infrastructure for modern operators

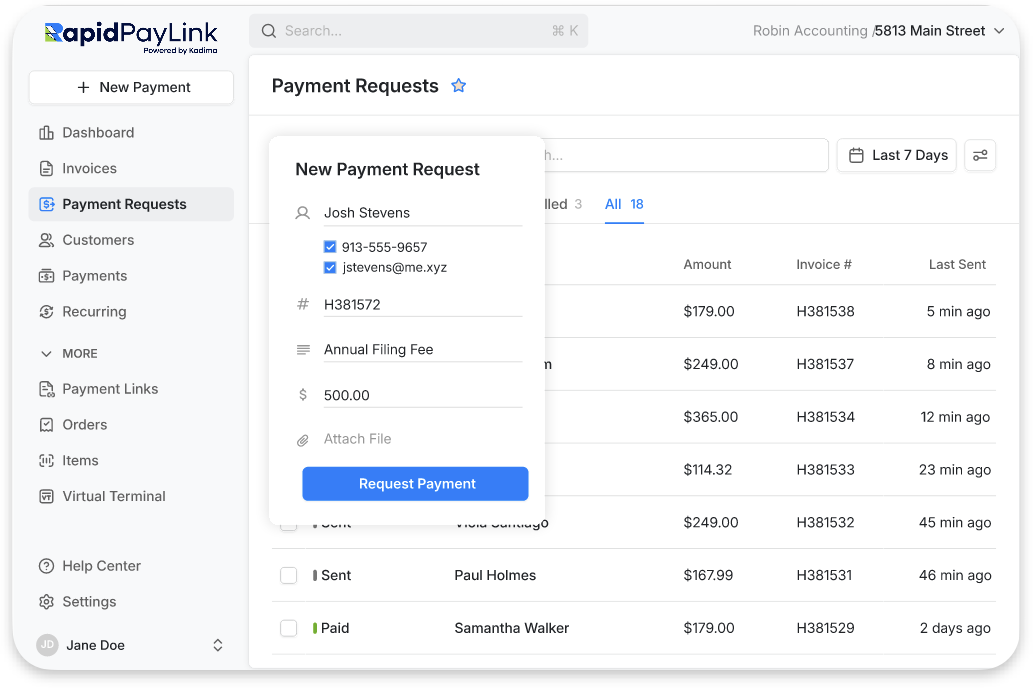

Stop chasing payments. Start controlling them.

RapidPayLink gives you control over how, when, and how reliably money moves — without adding complexity to your workflow.

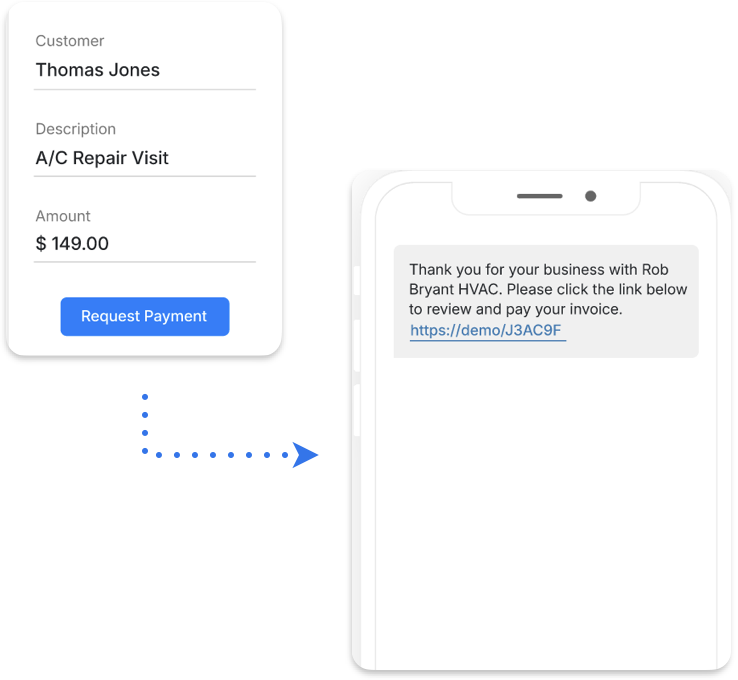

Invoice-to-text. Get paid faster.

Send an invoice by text or link and let customers pay instantly. No portals. No logins. No friction.

Know exactly where every dollar stands.

One dashboard showing paid, pending, and overdue — so you can act before cash flow becomes a problem.

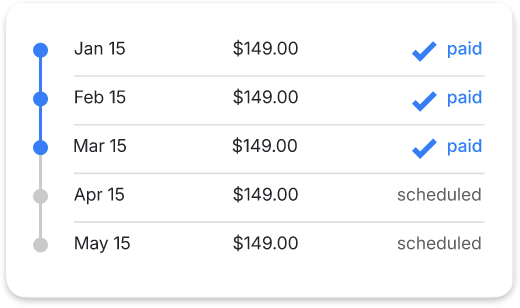

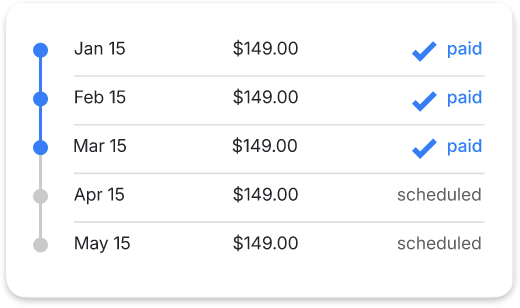

Recurring billing that runs itself.

Subscriptions, retainers, and monthly billing — automated, predictable, and fully controlled.

Kadima’s Payment Infrastructure

Built for businesses that have outgrown basic processors. Kadima provides modular payment tools designed to scale with volume, complexity, and risk — without breaking when things get real.

RapidPayLink™

Branded payment links that replace invoices, portals, and logins. Send a link. Get paid. Track everything.

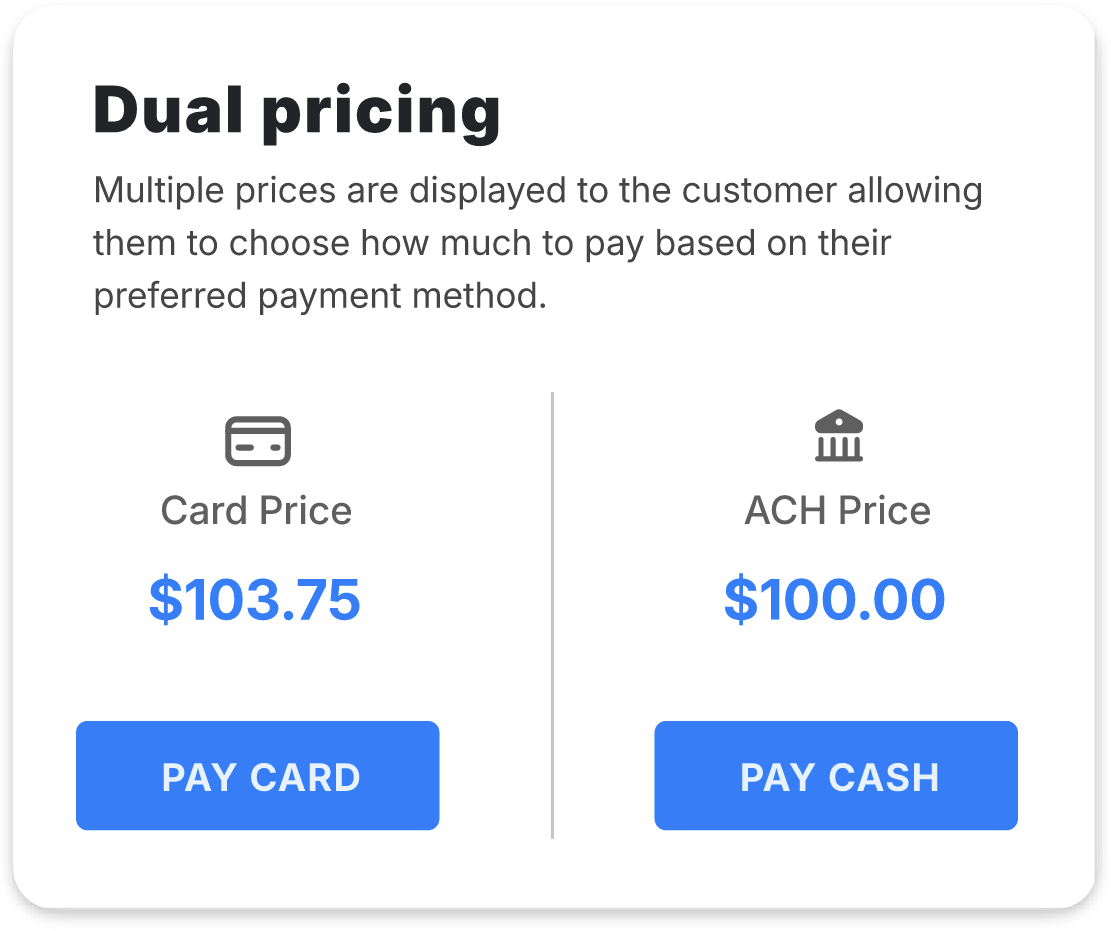

Dual Pricing Engine

Legally offset processing costs with compliant surcharge and cash-discount configurations.

ACH & Bank Payments

Lower fees, higher limits, and better cash-flow control for large or recurring transactions.

Embedded Payments & APIs

Integrate payments directly into your SaaS, quoting, or internal systems via our robust gateway.

In-Person Payment Infrastructure

Smart terminals and POS options built for compliant, connected, real-world payments.

Ready to Build on Kadima?

Talk to our team about the right infrastructure for your business.

Let’s Talk

Payments Built for

Every Industry

From everyday commerce to regulated, complex, and high-volume operations — Kadima delivers a payment stack that adapts to how your business actually runs.

Whether you’re selling products, booking services, or powering platforms, Kadima gives you faster settlements, smarter controls, and infrastructure that scales without surprises.

Explore Industries We ServePayment Architecture That Scales

Kadima is built for businesses that need stability, flexibility, and control — not shortcuts.

From everyday commerce to regulated, complex, and high-volume operations, our platform adapts

to how your business actually runs.

Flexible Processing Architecture

Card and ACH processing, dual pricing, gateway access, and settlement workflows — configured to fit your model, volume, and risk profile without forcing compromises.

Built for Complex Use Cases

Proven support for regulated industries, non-standard business models, and scaling operations that outgrow plug-and-play processors.

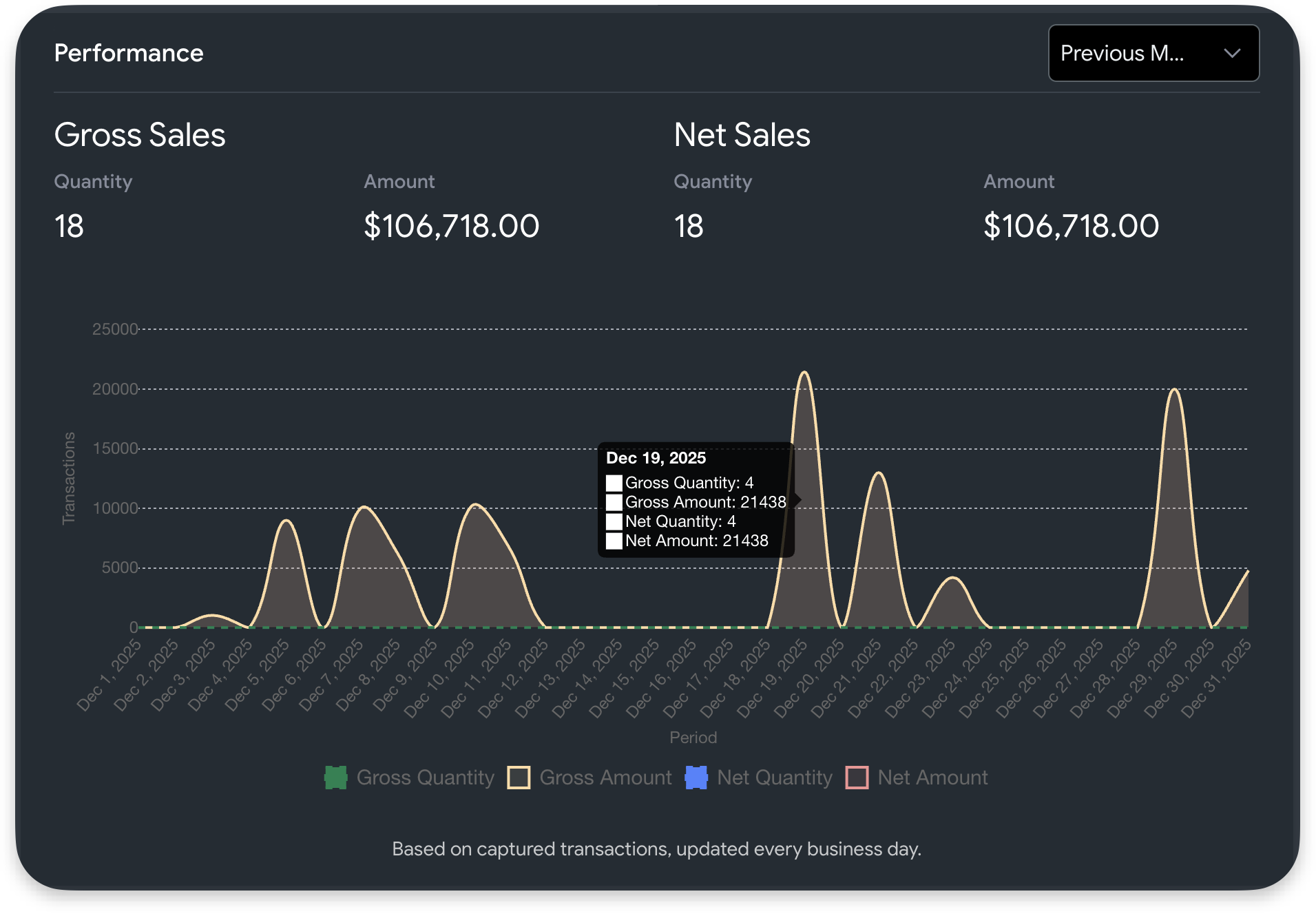

Operational Control & Visibility

Reporting, dispute management, fraud tools, and portfolio oversight — all designed to give you clarity as transaction volume and complexity increase.

Designed to Grow With You

Whether you’re processing thousands or millions, Kadima’s infrastructure scales without surprise shutdowns, hidden constraints, or platform lock-in.

Some of Our Partners

Kadima operates across multiple acquiring banks, gateways, and processing platforms — giving us the flexibility to place merchants on the right infrastructure from day one. We don’t force businesses into one system. We build around how they operate, scale, and manage risk.

Stop chasing payments.

Start controlling them.

Most businesses don’t lose money to bad customers, they lose it to bad systems.

You didn't need another tool,You needed control.

Why Kadima

Kadima is built for businesses that have outgrown consumer payment tools. One infrastructure layer — designed to handle complexity, scale, and real-world operations.

Predictable Cash Flow

Automated recurring billing, scheduled invoicing, and consistent settlement timing — so cash flow stops being a guessing game.

Cost Control by Design

Built-in dual pricing and ACH optimization that reduce processing costs without confusing customers or risking compliance.

Built to Scale

Unified dashboards, gateways, invoicing, and reporting — designed to support growing teams, higher volume, and more complexity.

Ready to get approved?

Apply in minutes. If your business needs enhanced underwriting, we’ll tell you exactly what’s required before anything moves forward.

Get Approved